Colby McGeachy Professional Corporation specializes in providing United States tax preparation services for US and Canadian citizens living cross-border in the United States, Canada and abroad.

We offer a broad range of professional services for individuals, businesses, executives, expatriates, investors, and independent professionals from our office in Almonte, Ontario, Canada.

Colby McGeachy’s United States and international tax practice helps individuals and businesses throughout Canada, the United States and abroad. We understand how regulations pertain to specific industries and we work closely with clients to help minimize their tax burden.

On June 26, 2012, the IRS announced new streamlined filing compliance procedures for non-resident U.S. taxpayers to go into effect on September 1, 2012. These procedures are being implemented in recognition that some U.S. taxpayers living abroad have failed to timely file U.S. federal income tax returns or Reports of Foreign Bank and Financial Accounts (FBARs) but have recently become aware of their filing obligations and now seek to come into compliance with the law. These new procedures are for non-residents including, but not limited to, dual citizens who have not filed U.S. income tax and information returns. Click here for full details on the streamlined procedure.

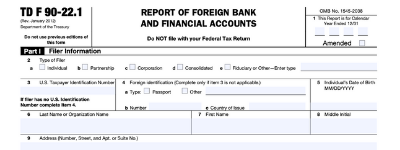

If you have a financial interest in or signature authority over a foreign financial account, including a bank account, brokerage account, mutual fund, trust, or other type of foreign financial account, and the balance has exceeded $10,000 at any point during the year, you are to report the accounts to the Internal Revenue Service by filing Form TD F 90-22.1, Report of Foreign Bank and Financial Accounts (FBAR). Click here for full details on the FBAR regulations.

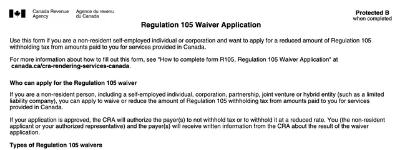

Canada requires 15% to be withheld on payments to non-residents for services or work performed in Canada.

The 15% withholding is not the final tax of the non-resident. Canada Revenue Agency considers the withholding to be a payment on account of the non-resident’s potential tax liability in Canada. Generally, non-residents are required to file a Canadian income tax return to calculate their tax liability or to obtain a refund of any excess withholding amounts.

Where a non-resident can demonstrate that the withholding is more than their potential tax liability in Canada, either due to treaty protection or income and expenses, Canada Revenue Agency may waive or reduce the withholding. Non-residents who want to request a waiver or reduction of withholding have to submit a Regulation 105 waiver application to the Canada Revenue Agency tax services office in the area where their services are to be provided. Waiver applications have to be submitted no later than 30 days before the period of service begins, or 30 days prior to the initial payment for the related services.

Under the Canadian Income Tax Act, employers are required to withhold income tax at source in respect of their nonresident employees’ Canadian-source compensation related to services rendered in Canada. The amount of the withholding is determined in accordance with section 102 of the Income Tax Regulations (commonly referred to as “Reg 102” withholding). The employer may be relieved of this withholding obligation only where a formal waiver is obtained from the CRA and, if services were rendered in the province of Quebec, the Minister of Revenue of Quebec. Waivers may be obtained for a number of reasons, including where the employment income of the nonresident employee would be exempt from Canadian taxation under a tax treaty.

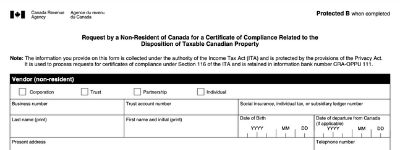

Non-residents disposing of certain taxable Canadian property must file a Form T2062 and if it is a rental property Form T2062A as well, in order to obtain a Section 116 Certificate of Compliance. This certificate, once obtained, is presented to the purchaser. If the purchaser does not receive such a certificate, they are required to withhold and remit tax from the purchase proceeds on behalf of the non-resident vendor.

Notification of a sale must be sent to Canada Revenue Agency within 10 days of a sale as required in subsection 116(3), and can be by fax, providing names and address of the vendor and purchaser, description of the property, its proceeds and cost. Failure to notify Canada Revenue Agency within 10 days of a sale can result in late filing penalties of up to $2,500.

Each vendor must obtain an Individual Tax Number or Social Insurance Number. If the individual non-resident vendor does not have an Individual Tax Number or a Social Insurance Number, complete form T1261 and submit it along with the required supporting documentation. A complete list of required documents can be found on form T2062. Look under “Forms and Publications” on the Canada Revenue Agency website at www.cra-arc.gc.ca.